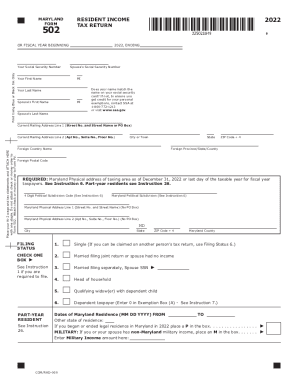

Who needs the Comptroller 502 form?

The Comptroller 502 form is a State of Maryland form specifically designed by the Department of Revenue to enable State residents and part-year residents to file their Resident Income Tax Returns. Generally, all individuals whose permanent place of residence is or was in Maryland in 2015 or who maintained a place to live for over six months of the tax year and were physically present in Maryland for at least 183 days are supposed to file the 502 form. The part-year residents who began or ended residence in the state must also file the given Resident Income Tax Return with minor exceptions that can be checked in the instructions

What is the 502 form for?

Filing the income tax return allows the resident to report yearly income made in the state and pay due taxes or receive a refund for overpayment.

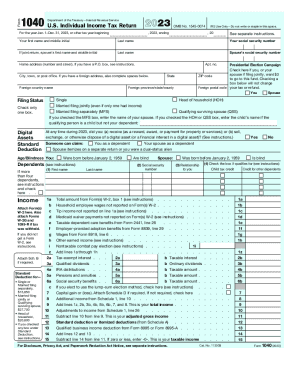

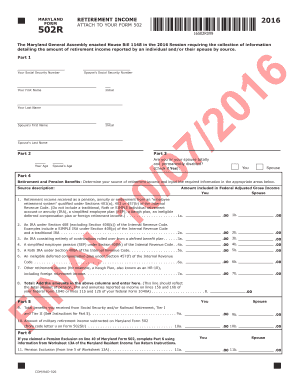

Should the form be accompanied by any other documents?

The report income in Maryland, except for the 502 form (or 502B whichever is relevant), a resident is to submit the following documents:

- Form 588 (in case of election to get the refund deposited to two or more accounts);

- Forms W-2(s) or 1099(s) (reflecting the amount of Maryland tax withheld);

- Schedules K-1 (also explaining Maryland tax withheld and/or providing information about Maryland tax credit).

If a resident is claiming credits or subtractions, additional schedules can be required according to the instructions.

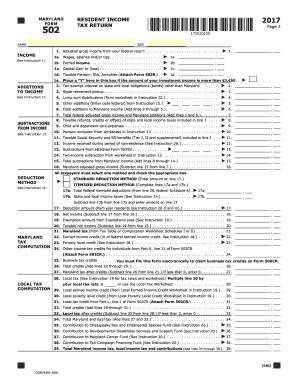

When is the form due?

Along with all the supporting documents, the MD 502 form must be submitted by April 2016 for the tax year 2015.

Where do I send the completed Resident Income Tax Return?

The filled out form and the supporting documentation must be delivered to the Comptroller of Maryland, Revenue Administration Division, Taxpayer Service Section at the address: 110 Carroll Street, Annapolis, MD 21411. In case the filer has a balance due, a money order or check (bearing the resident’s SSN) payable to the MD Comptroller must be included too.